The Benefits of Investing in Gold vs. Stocks

Share

The Benefits of Investing in Gold vs. Stocks

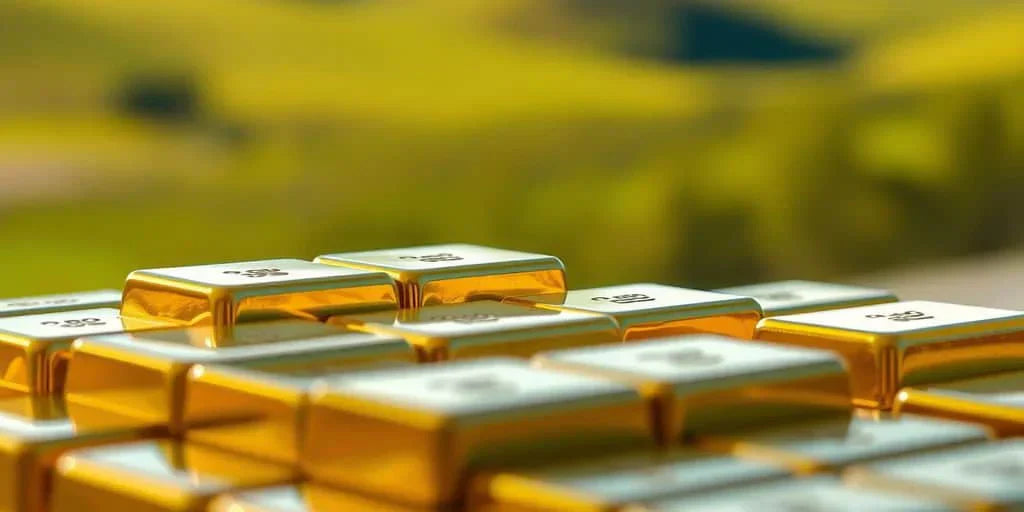

Investors often debate whether to allocate their wealth into gold or stocks. Both investment vehicles offer unique advantages, but gold provides security that stocks cannot. Below, we compare the benefits of investing in gold versus stocks.

1. Stability vs. Volatility

-

Gold: Gold prices remain stable over time, making it a safe-haven asset.

-

Stocks: Stocks can be highly volatile, influenced by economic cycles and market trends.

2. Inflation Protection

-

Gold: Historically, gold prices rise with inflation, maintaining purchasing power.

-

Stocks: Inflation can erode stock market returns, especially if companies struggle with rising costs.

3. Tangibility

-

Gold: A physical, tangible asset that cannot be digitally erased or manipulated.

-

Stocks: An intangible asset subject to corporate governance and potential fraud.

4. Liquidity

-

Gold: Highly liquid and can be sold anywhere in the world.

-

Stocks: Liquidity depends on market conditions and trading hours.

5. Long-Term Wealth Preservation

-

Gold: Retains value across generations and serves as a lasting store of wealth.

-

Stocks: Can generate wealth but are dependent on economic conditions.

Final Thoughts

While stocks offer growth potential, gold provides stability and protection against economic downturns. Smart investors diversify their portfolios by holding both assets. If wealth preservation is your goal, gold remains the ultimate choice.

At GOLDAMAC Inc., we offer premium 24K gold bars to help you build a secure financial future. Explore our collection today!

#GoldVsStocks #InvestInGold #WealthProtection #GoldInvestment #SafeHaven #GOLDAMAC